Actually, it isn’t quite as easy as it sounds.

In fact it is very difficult to build a profitable in-home day care businesses. There are 2 key reasons why the in home day care business model is difficult:

- Capacity Constraints – Typically the state will determine the number of children that can be cared for in one home based daycare. As an example in Kansas the maximum is 12 children under the age of 16 per home. This limits the revenue potential for the home. It is kind of like getting into the home rental business. You are not going to get rich renting out one home because you can only charge so much for rent. You would need many rental properties all producing a small profit to reach a sustainable and profitable level. Likewise you will likely need multiple home day cares to really make the finances work well for you.

- High Startup Costs – Because you will need to meet a long list of requirements set by your state (Example here),

you will likely incur $10,000 or much more in startup costs to prepare a

home to be compliant. A few examples of startups costs include:

- Fire Extinguisher

- Toys indoor and outdoor

- Fence

- Bathrooms appropriate for children

- Office for reports and paperwork

- Plans, policies, and procedures

- Separate rooms for different age groups

Financial Model Example for Home Day Care

So now I want to create a template that you can use to create your own financial projections for your in home day care. I will publish the Excel template at the bottom of this post, but I am also going to show you screenshots on how to use our web app, ProjectionHub, to create your day care projections.Sales Projections

Once you sign up for an account with ProjectionHub the first step is creating your sales projections. In all likelihood you will be paid by the hour.Hourly rates – for child care can vary drastically depending on your location, programming, experience, and most importantly the age of the children you are watching. You can bill more per hour for an infant typically because infants require more caregivers per child. Care.com has an excellent babysitting rates calculator that will estimate how much you can charge for care in your location.

Maximum revenue – Once you know an average hourly rate you will charge, the maximum number of children you can watch at any given time, and the number of hours you will be open each month, you can calculate your maximum monthly revenue. This will be helpful because it gives you a quick dose of reality to determine whether this is worth your time. As an example let’s say you are going to charge $7 per hour for a maximum of 12 children, for a maximum of 200 hours per month. Maximum Total Revenue = $16,800/month

Now that we have some ball park numbers, let’s enter some actual sales projections into ProjectionHub:

So here is what I assumed to come up with these sales projection entries:

- There is a maximum of 3 infants because the typical child to caregiver ratio for infants is 3 to 1.

- The hourly rate for infants is $8

- The maximum number of billable hours per month for 3 infants is 600

- I started the projections in month 1 assuming a 50% utilization rate, so 300 billable hours

- I assumed a monthly growth rate of 3% for the first year

- For year 2 and 3 I kept sales at 500 billable hours per month

- Up to 9 children

- Hourly rate is $6

- Maximum number of billable hours per month for 9 children is 1800

- I started the projections in month 1 assuming 1,000 billable hours

- I assumed a monthly growth rate of 4% for the first year

- For year 2 and 3 I kept sales at 1,500 billable hours per month

Cost of Goods Sold for a Day Care

Next you will need to enter estimated cost of goods sold for a day care. Technically your labor costs and food costs should probably be considered cost of goods sold, but the problem is that we structured the sales projections by the billable hour. So if we try to enter in wages and food costs in by the billable hour, I think we are going to have some difficulties, so I am leaving COGS blank.Salaries

In this case your primary labor cost is for caregivers. In our example we are assuming only 3 infants which means you will need 1 person caregiver at a time. Let’s assume we pay the infant caregiver $12 per hour. So we assume you will have to have this person 10 hours per day, 5 days a week, 4 weeks a month for a total monthly cost of $2,400 (Annually $28,800) plus employer taxes of approximately 10%.

Next for the non-infants we will assume that you pay $11 per hour for a annual cost of $26,400 plus 10% for taxes. We will assume you will need 2 of these employees.

General Expenses for a Day Care

Next we need to add some general monthly expenses for a day care. Here are expenses that I added:- Accounting/Bookkeeping – $100/mo

- Insurance – $30/mo

- Maintenance – $50/mo

- Supplies – $30/mo

- Phone – $50/mo

- Utilities – $150/mo

- Food – $400/mo

- Rent – $700/mo (you will likely pay rent or have a mortgage on the home)

Startup Costs for a Day Care

I would expect that you would want to have $20,000 in cash to start an in home day care. $10,000 to pay your first few weeks of payroll and other expenses while you wait to get paid from customers/government funding programs. Then I expect the following startups costs:

- $1,000 in inventory

- $5,000 in renovations to your house to earn license

- $1,000 for equipment and toys

- $3,000 for furniture like cribs, tables and chairs

We have now finished your projections, so let’s check out your results.

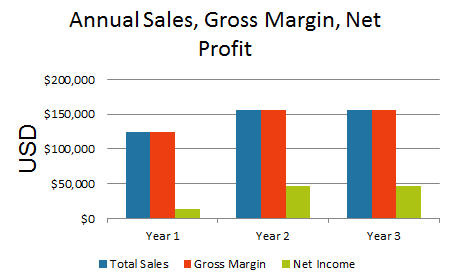

As you can see the first year is just marginally profitable, with a projected net income of $13,683. This is your take home in the first year. In years 2 and 3 we projected a fairly aggressive occupancy rate, and the net income increases to just under $50,000 per year.

So now the question is whether it is worth it to you? You can see that if everything goes right you can expect just under $50,000 in net income per year and free cash flow of closer to $40,000. Then you have to pay taxes on the net income and by the time it is all said and done you have to consider that you are going to have up to 12 kids in your house for 10 hours per day, 5 days per week. Is being able to take home about $40,000 per year worth it? You might decide that you can go get a job that is less stressful and produces the same amount of income.

No matter what you decide, it is important to know the facts and know your earning potential before you take the risk and make the investment to start an in home day care. Good luck!

You can download the completed Da